Features Included with Membership

ScoreMaster® has your money, credit and identity in one place with Action buttons and score tools.

Using ScoreMaster®

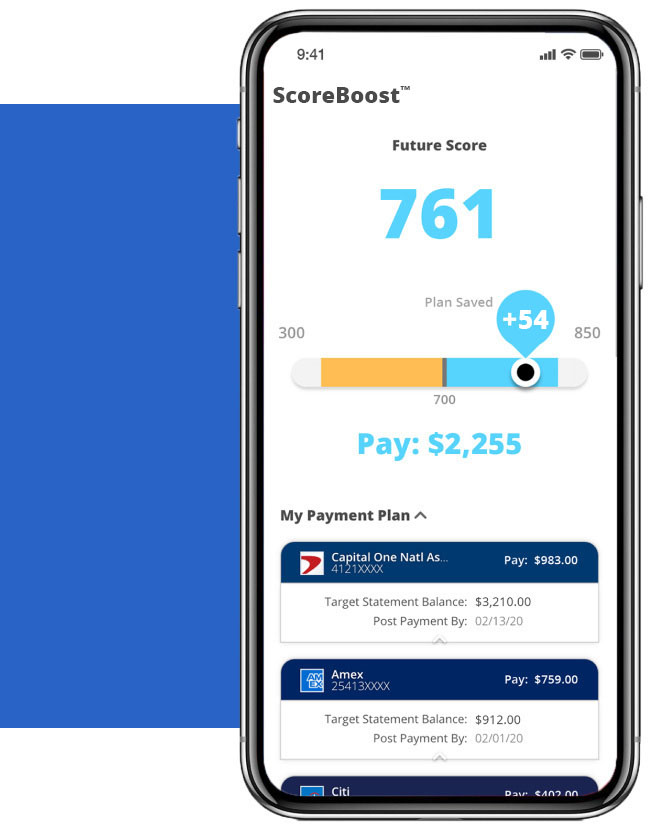

Using ScoreBoost™

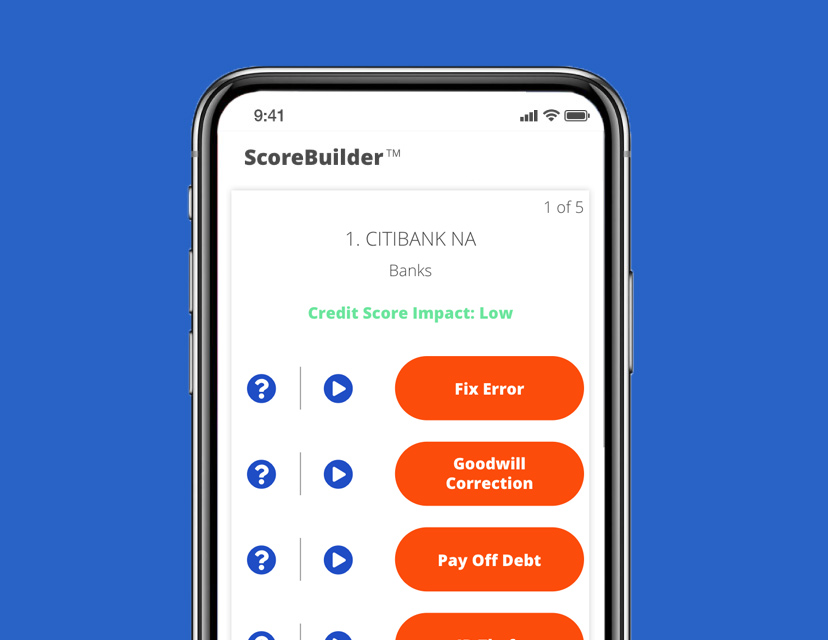

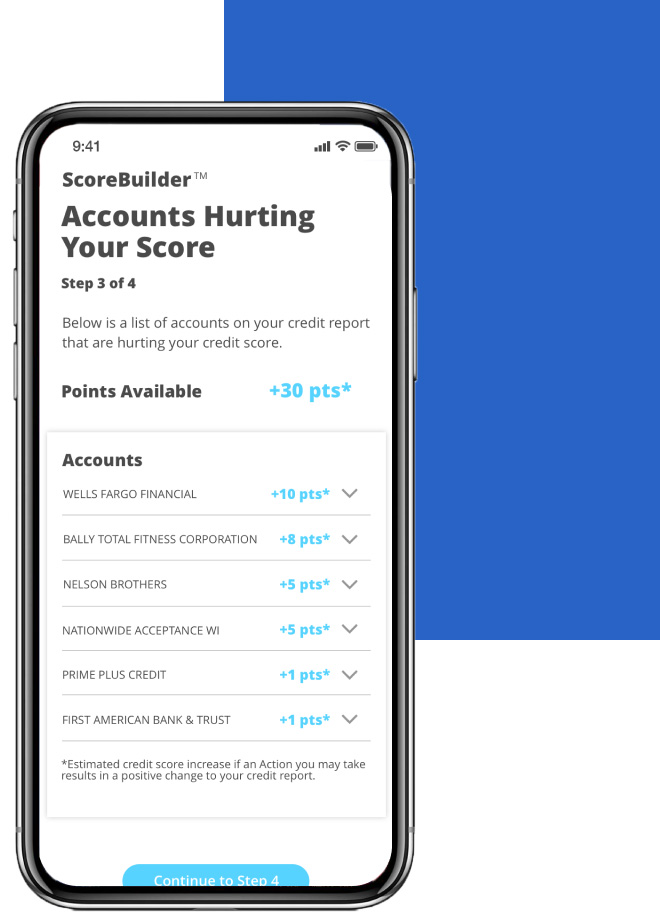

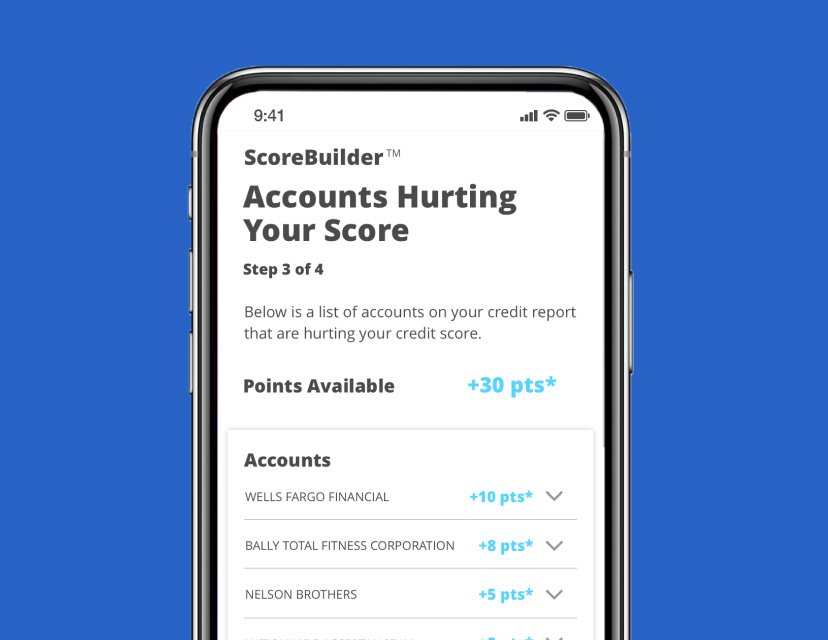

Using ScoreBuilder®

Using ScoreBuilder®

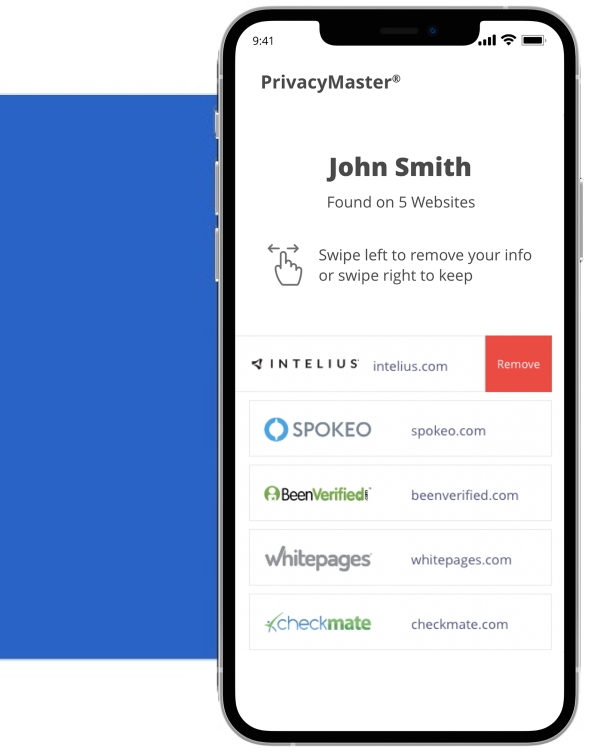

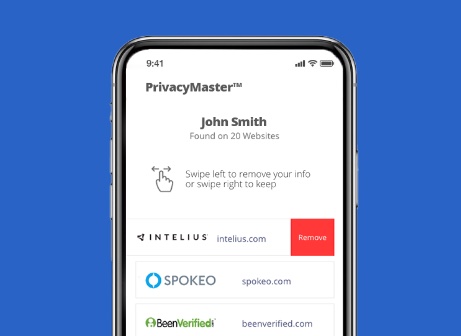

Using PrivacyMaster®

Using PrivacyMaster®

Additional Features

Smart Credit Report®

A simple and innovative way to view your credit report. Use Action buttons to quickly ask questions and resolve problems.

Money Manager

All your online banking in one place. Use Action buttons to quickly ask questions and resolve problems.

$1 Million Fraud Insurance

Covers Bank, Savings, Brokerage, Lines of Credit, Credit Card and more for your whole family.

Activation required after enrollment.

Alerts

Receive alerts for suspicious activity, payments due & credit monitoring events. Link your phone to get alerts faster.

Action Buttons

With a simple button you can remove identity theft, negotiate debts, resolve reporting problems and ask questions directly with your creditors.

3B Report & Scores

View a side by side comparison of how your credit report looks across all 3 credit bureaus. Keep your reports free of any errors.